Commerce Wars Might Be What The Housing Market Wants To Warmth Up

As a inventory market investor, I’m disillusioned within the new tariffs President Trump has imposed—10% on imports from China and 25% on imports from Mexico and Canada, together with a 10% obligation on Canadian power imports (oil, pure gasoline, electrical energy). If these tariffs persist all 12 months with out decision, company earnings may take a 2%-3% hit, which implies an identical drop within the S&P 500 or extra wouldn’t be stunning.

As anticipated, the retaliations got here quick. Canada’s soon-to-be-gone Prime Minister Trudeau hit again with matching 25% tariffs on $155 billion price of U.S. imports, concentrating on alcohol and fruit, which may considerably affect main U.S. exporters.

In the meantime, Mexico’s President Sheinbaum rejected Trump’s claims about Mexico collaborating with felony organizations and carried out her personal retaliatory tariffs on U.S. items. She additionally urged the U.S. ought to give attention to preventing home drug commerce and cash laundering fairly than blaming Mexico.

China’s finance ministry stated Tuesday, Feb 4, it can impose further tariffs of 15% on coal and liquified pure gasoline imports from the U.S. and 10% greater duties on crude oil, farm gear and sure automobiles, beginning Feb. 10, 2025.

That is the basic “standing at a live performance” analogy—if one particular person stands up, the row behind them has to face up too, leaving no person higher off. Tariff wars are inclined to observe the identical sample, so the logical consequence is a compromise. The query is: how lengthy will markets should endure the uncertainty earlier than that occurs?

Commerce Wars Might Enhance the Housing Business

Everybody is aware of tariffs harm the worldwide economic system, which is why a rational Trump will seemingly negotiate a compromise. Nevertheless, with new tariffs on European items additionally on the desk, it’s unclear how rapidly world leaders will attain an settlement earlier than shopper confidence takes a significant hit.

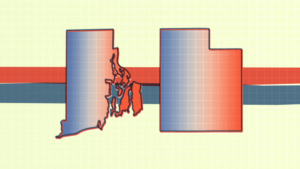

Regardless of the market disappointment, as an actual property investor, I see an upside: commerce wars may gasoline a housing increase.

As commerce tensions escalate, capital ought to stream from riskier belongings like shares into Treasury bonds, pushing yields decrease. If fears of a world slowdown intensify, mortgage charges may drop considerably, enhancing affordability and spurring demand for housing.

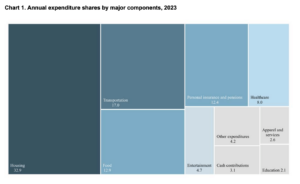

When housing affordability will increase, so do actual property transactions, transforming tasks, furnishings purchases, landscaping jobs, and mortgage originations. The housing trade is a key driver of the U.S. economic system, usually accounting for 15%–18% of GDP. With an present housing scarcity and years of pent-up demand, decrease charges may reignite bidding wars nationwide.

Actual Property As A “Bonds Plus” Funding

I’ve by no means been large on bonds (~2% of my internet price) as a result of I favor higher-risk, higher-reward investments. I see actual property as a bond different, providing potential appreciation, lease will increase, and tax benefits. Over the previous 22 years, my actual property holdings have outperformed Treasury bonds and the mixture bond index, and I count on that to proceed.

After all, proudly owning bodily actual property isn’t passive. This previous weekend alone, I spent three hours portray my outdated home after my tenants moved out. Subsequent up: changing grout, energy washing, deck touch-ups, and landscaping the entrance yard. Whereas I take pleasure in presenting a terrific product, the upkeep work takes time away from different pursuits.

As I become old, I discover myself naturally shifting towards extra on-line actual property investments and away from bodily property possession. The attraction of a easier, lower-maintenance life is rising—similar to the housing market may if mortgage charges drop.

Taking Benefit of the Inventory Market Promote-Off

Throughout his earlier time period, former President Donald Trump initiated main commerce conflicts, most notably with China, beginning in July 2018. The U.S. imposed tariffs on roughly $550 billion price of Chinese language items, whereas China responded with tariffs on about $185 billion price of U.S. items. The tensions triggered market volatility earlier than culminating within the Section 1 commerce deal in January 2020, which eased some disputes.

On July 18, 2018, the S&P 500 stood at 2,800 earlier than promoting off to 2,485 by December 18, 2018—an 11% decline. Nevertheless, by January 2020, the market had rebounded to 3,300, delivering a formidable 32% achieve. If historical past repeats itself, a 10%+ correction may current a powerful shopping for alternative.

Market pullbacks at all times really feel painful within the second, however they’re nothing new. Since 1950, the S&P 500 has skilled a correction (declines of 10% or extra) roughly each 19 months. Since 1980, the typical intra-year decline has been 14.3%, making double-digit drops comparatively frequent. In the meantime, bear markets (declines of 20% or extra) happen about as soon as each six years on common.

On condition that I am presently underweight public equities, I’m desirous to purchase the dip and I did aggressively Monday morning. However what excites me much more? Shopping for the dip for my youngsters—a transfer I hope they’ll respect 10-15 years down the street after they’re in highschool or faculty.

U.S.A. Will Win The Struggle

In a sport of hen, who wins? Clearly, the greatest participant with the biggest skill to resist a collision. I count on different nations to concede to a lot of our calls for in the event that they need to keep away from spiraling right into a recession.

As of now, there’s a pause on tariff implementation for 30 days with Canada and doubtlessly with Mexico and China because the respective leaders determine issues out.

Readers, how lengthy do you suppose this commerce battle will final? Will it push capital into actual property and drive residence costs greater? How are you positioning your investments?

Disclaimer: This isn’t funding recommendation to you, solely my ideas about how commerce wars can have an effect on completely different threat belongings. Please do your personal due diligence and make investments in accordance with your threat tolerance and monetary targets.

Subscribe To Monetary Samurai

When you’re trying to put money into high-quality residential and industrial actual property, contemplate Fundrise. Based in 2012, Fundrise focuses on properties within the Sunbelt area, the place valuations are decrease and yields are greater. With a resilient economic system and the potential for decrease rates of interest forward, industrial actual property could possibly be a wise technique to diversify your portfolio and generate passive revenue. I’ve invested $300,000+ in Fundrise and Fundrise is a long-time sponsor of Monetary Samurai.

Pay attention and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview specialists of their respective fields and focus on a number of the most attention-grabbing subjects on this web site. Your shares, rankings, and opinions are appreciated.

To expedite your journey to monetary freedom, be part of over 60,000 others and subscribe to the free Monetary Samurai e-newsletter. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Every little thing is written primarily based on firsthand expertise and experience. Learn my About web page for more information.