Awaken Your Interior Vulture Investor To Survive And Thrive

With fears of a recession rising once more largely because of the Trump administration’s aggressive coverage measures—tariffs, spending cuts, aggressive layoffs, and an more and more combative commerce stance—it’s time to awaken the vulture investor inside. Each Important Avenue and Wall Avenue are liable to dropping some huge cash now.

I don’t significantly benefit from the concept of being a vulture investor. It feels exploitative, capitalizing on the misfortune of others. However in a capitalistic society, opportunism isn’t simply inspired—it’s important for survival. If the fast indiscriminate firings of federal authorities staff train us something, it is that the wealthy and highly effective do not care about you! Subsequently, you will need to change your mindset to go on the offensive.

Each market downturn triggers a wealth switch, transferring cash from the unprepared to the ready, from the weak to the sturdy. Should you refuse to undertake a vulture mindset throughout unsure instances, you threat turning into the prey. Embracing this method is each a defensive safeguard and an offensive technique for seizing alternatives.

A Bear Market May Simply Come Again

We’ve simply skilled two phenomenal years of inventory market returns. A pure reversion to the historic valuation imply of 18x earnings might simply pull the S&P 500 down by 15% or extra from present ranges. If that’s the case, we must always count on to see an acceleration of mass layoffs.

Whereas that draw back transfer could seem excessive, so is the continued tariff flip-flopping, which in the end hurts client sentiment. Give it some thought—if confidence sooner or later fades, the logical response is to avoid wasting, not spend. If too many individuals begin saving, a recession ensues.

Though the NASDAQ has corrected by ~11% already, there’s not precisely blood on the streets but, with the S&P 500 solely down about ~7.5% from its peak. Nevertheless, if self-inflicted wounds proceed to mount, a savvy vulture investor is aware of to maintain money able to pounce on rising alternatives.

The Purpose of a Vulture Investor

A vulture investor’s mission is straightforward: establish distressed property, watch for capitulation, and strike when the value is correct.

Like precise vultures circling the dying, monetary vultures should train endurance and self-discipline. As an alternative of chasing property at inflated costs, you will need to watch for pressured sellers—those that can now not maintain on as a consequence of extreme debt, financial hardship, or mismanagement.

I’ve made vulture investing sound immoral because of the phrase “vulture.” I might have simply modified the time period to “Alternative Investing” or “Strategic Investing” to make being opportunistic sound higher. Nevertheless, in a free market, most of us have the flexibility to purchase or promote something we would like.

The early warning indicators are already right here:

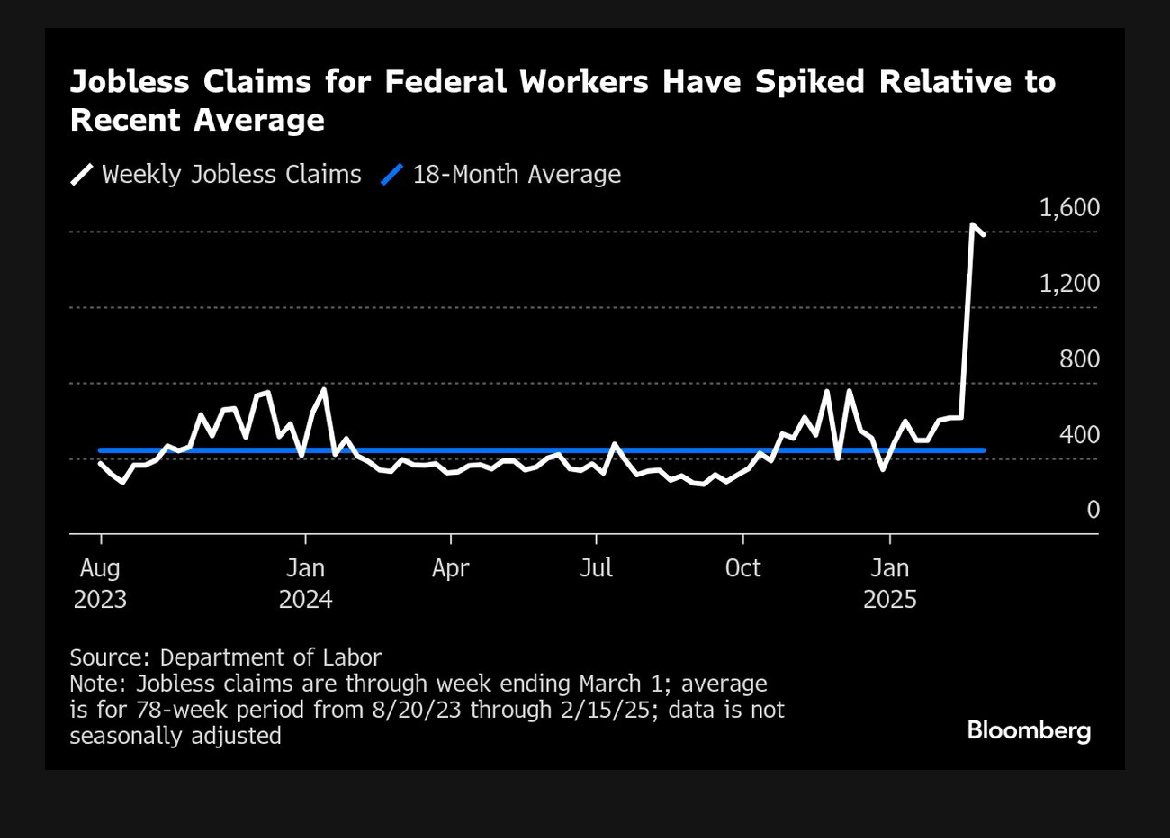

Job cuts are accelerating – Firms are trimming fats, making ready for leaner instances. Layoffs ripple by way of native economies, creating secondary misery in housing, client spending, and small enterprise revenues.

Family debt ranges and delinquencies are inching greater – Some householders stretched themselves skinny to afford property at traditionally low rates of interest. Whereas bank card debt and auto mortgage debt proceed to rise. With charges nonetheless elevated, carrying prices are biting exhausting.

Industrial actual property stays fragile – Workplace vacancies are nonetheless excessive, and if firms begin downsizing additional, landlords with an excessive amount of leverage might be in huge hassle.

Erratic and unpredictable authorities – When authorities actions are inconsistent, it turns into troublesome to make dependable projections about an organization’s efficiency and the broader economic system’s path. The free market needs much less authorities intervention, no more.

GDP development is decelerating or might even be declining – The Atlanta Fed is forecasting 1Q2025 GDP development of -1.5%.

Who to Prey On as a Vulture Investor

To capitalize, vulture traders should know the place to search for alternative. As long as the funding is authorized, it’s inside your proper to benefit from the scenario. Listed here are some targets to think about:

1. Householders Who Overleveraged

Through the post-pandemic housing growth, many patrons ignored conventional affordability guidelines. As an alternative of following the 30/30/3 rule (spend not more than 30% of gross earnings on a mortgage, put down at the least 30%, and don’t purchase a house greater than 3x your annual earnings), they stretched themselves skinny, banking on low mortgage charges and rising dwelling costs.

Now, with persistently excessive rates of interest and rising layoffs, pressured promoting and foreclosures might improve. This can be very true in states that overbuilt, resembling Florida, Texas, Tennessee, and Colorado. Moreover, mass layoffs within the Washington D.C. space might result in a surge in dwelling listings as householders downsize. A savvy vulture investor screens foreclosures developments and waits patiently for properties to hit public sale at steep reductions.

2. Small Enterprise Homeowners Who Took On Too A lot Debt

The surge in small enterprise formation throughout 2020-2022 was spectacular, however many companies survived on low cost debt and authorities assist. Now, with greater borrowing prices and weaker client spending, these with out sturdy money stream or pricing energy will wrestle.

As a vulture investor, you may search for:

• Companies pressured to liquidate property at reductions (actual property, tools, mental property).

• Buying distressed firms with sturdy fundamentals however short-term money stream points.

• Shopping for into struggling however promising startups at fire-sale valuations. Throughout downturns, shopper development slows and it is a lot tougher to get funding.

3. Overleveraged Industrial Actual Property Homeowners

Though recovering, the industrial actual property sector stays in a precarious place. If a recession hits, the post-pandemic return-to-office pattern might stall, as firms will freeze hiring or downsize, decreasing workplace house demand additional.

In the meantime, many landlords refinanced their properties at rock-bottom rates of interest and are actually dealing with ballooning debt funds with few choices to refinance affordably. Those that can’t restructure might be pressured to promote, creating prime alternatives for deep-pocketed traders.

4. Giant Firms With Extreme Debt

Company debt ranges soared when charges had been close to zero. Now, with borrowing prices a lot greater, overleveraged corporations face an earnings squeeze. The weakest firms will:

• Dump divisions or property at distressed costs.

• Restructure by way of chapter, wiping out current shareholders.

• Difficulty dilutive secondary inventory choices to remain afloat.

Vulture traders can revenue by:

• Shopping for bonds of distressed firms at steep reductions.

• Buying cash-generating divisions spun off by struggling corporations.

• Brief-selling overvalued, debt-laden firms earlier than they collapse.

5. Panic Sellers within the Inventory Market

The wonder and curse of the inventory market is its emotional nature. Concern-driven promoting can create unimaginable bargains, very like we noticed in March-April 2020 when nice firms had been buying and selling at absurdly low valuations.

Vulture traders:

• Construct a watchlist of high-quality firms with sturdy fundamentals (sturdy free money stream, giant steadiness sheets, giant moat, and so forth) which will get unfairly punished by panic.

• Search for indiscriminate promoting primarily based on macroeconomic and policy-driven panic somewhat than company-specific issues.

• Use dollar-cost averaging to purchase in phases as costs fall additional.

6. Former Startup Staff with Illiquid Inventory

In troublesome instances, some staff holding inventory choices or fairness in non-public firms might look to dump their shares at a reduction. Vulture traders can:

- Purchase shares in struggling however promising non-public firms on the secondary market.

- Search for pre-IPO firms with sturdy fundamentals however non permanent money stream points.

- Negotiate with ex-employees who want liquidity earlier than an organization can go public or be acquired.

7. Trip Householders Hit by Rising Prices

Many patrons rushed into trip houses in the course of the pandemic, anticipating sturdy rental demand to subsidize working prices. Now, with greater mortgage charges, insurance coverage prices, and a slowdown in trip dwelling purchases, some are struggling to carry on. Vulture traders can:

- Scoop up discounted trip properties in overbuilt markets.

- Goal Airbnb traders who can now not cowl their prices.

- Search for resort-area actual property owned by overleveraged traders.

8. Distressed Luxurious Asset Sellers

Financial downturns typically drive people to promote luxurious property at a reduction. Alternatives embody:

- Excessive-end watches from manufacturers like Rolex and Patek Philippe.

- Basic and unique automobiles that require expensive upkeep.

- Yachts and personal planes from homeowners trying to downsize their life.

9. Overleveraged Crypto and NFT Speculators

The crypto growth led many traders to borrow towards their digital property. Now, with crypto market volatility, some could also be pressured to promote:

- Bitcoin, Ethereum, and different property at distressed costs.

- Excessive-value NFTs from collections like Bored Ape Yacht Membership or CryptoPunks.

- Crypto-backed actual property and different property which have gone underwater.

10. Landlords Fighting Lease Management and Evictions

In cities with strict lease management legal guidelines or sluggish eviction processes, some landlords could also be unable to boost rents or take away non-paying tenants. This could push them to promote properties under market worth. Vulture traders can:

- Goal distressed multi-family properties the place homeowners are uninterested in coping with rules.

- Purchase single-family leases from landlords who can’t sustain with rising prices and stagnant lease development.

- Hunt down mom-and-pop landlords trying to exit the rental enterprise altogether.

11. Divorcees Going through Asset Liquidation

Divorce typically forces the sale of property, together with houses, companies, and funding portfolios, at inopportune instances. One partner may have to dump actual property rapidly to divide property, or a enterprise might be bought under truthful worth to settle a break up. Vulture traders can:

- Establish luxurious properties being bought at a reduction as a consequence of divorce settlements.

- Search for companies that one partner is pressured to promote, particularly these with sturdy fundamentals however non permanent misery.

- Purchase out funding portfolios or non-public fairness stakes that one partner must liquidate.

12. Overleveraged Automotive Homeowners Going through Repossession

Shopping for an excessive amount of automotive is the #1 private finance wealth killer. This realization led me to develop the home-to-car worth ratio, a easy guideline to assist individuals make smarter spending selections. The current surge in automotive mortgage delinquencies means that many homeowners, significantly these with luxurious autos, are struggling to maintain up with their funds. Vulture traders can:

- Purchase repossessed autos at public sale for resale or rental fleets.

- Supply private-party money offers to determined sellers earlier than repossession.

- Purchase automotive rental companies liquidating their stock as a consequence of monetary struggles.

The Energy of Money: Your Final Weapon

The very best vulture traders don’t simply acknowledge alternative—they’ve the liquidity and the braveness to behave. Most individuals who get into hassle accomplish that by taking up extreme debt, leaving them weak when a downturn hits.

One of many greatest dangers in a downturn is being pressured to promote property on the worst time. Savvy traders keep away from this destiny by sustaining sturdy money reserves and having a transparent recreation plan for when to deploy capital.

Should you’re sitting on money, a downturn isn’t one thing to concern—it’s a chance. The extra uncertainty and panic available in the market, the extra negotiating energy you’ve as a purchaser.

Overlook about solely have six months of residing bills in money. A vulture investor has years of money able to deploy!

So Wealthy You Don’t Care How A lot You Quickly Lose

One of many greatest risks of electing billionaires policymakers to run the economic system is that they may not really feel as a lot ache as the remainder of us throughout downturns. When you’ve lots of of hundreds of thousands or billions in wealth, dropping some huge cash means nothing.

However for the typical investor, home-owner, or small enterprise proprietor, a downturn may be catastrophic. That’s why pondering like a vulture investor isn’t nearly getting cash—it’s about monetary survival. You hope you by no means have to enter vulture investing mode, however you are ready if it’s essential to.

Whether or not you prefer it or not, downturns can create life-changing alternatives for individuals who are ready. Those that wolfed up shares and actual property in the course of the 2008 International Monetary Disaster are sitting on large fortunes at present. In the meantime, those that bought shares and foreclosed on their houses again then have doubtless fallen behind for good.

If historical past is any information, wealth will as soon as once more switch from the weak to the sturdy, from the overleveraged to the liquid, from the fearful to the opportunistic.

The query is: Which aspect will you be on?

Solutions To Enhance Your Funds

To higher plan to your monetary future, take a look at ProjectionLab. It permits you to create a number of “what-if” situations to arrange for any scenario. The extra you intend, the higher you may optimize your monetary selections.

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and talk about a few of the most fascinating subjects on this website. Your shares, scores, and opinions are appreciated.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai e-newsletter. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Every little thing is written primarily based on firsthand expertise and experience.