Chaos, Concern, And Uncertainty: Fantastic For Actual Property Traders

As I watch my inventory portfolio appropriate, I take solace in realizing that my actual property portfolio continues to chug alongside regardless of the chaos, worry, and uncertainty.

With mass authorities personnel cuts, new tariffs towards Mexico, Canada, and China, a heated Oval Workplace alternate between President Trump and Ukraine’s President Zelensky, and sharp phrases from VP Vance about Europe, financial uncertainty is surging. Whereas the inventory market despises uncertainty, actual property buyers may discover alternative within the turmoil.

The Begin of Commerce Wars In March 2025

In 2023, Canada despatched 76% of its exports to the US, accounting for 19% of its GDP. In 2024, Mexico despatched 78% of its exports to the U.S., making up 38% of its GDP. In the meantime, U.S. exports to each Canada and Mexico mixed account for under about 2.7% of U.S. GDP. Clearly, Canada and Mexico might want to make concessions—in any other case, their economies will doubtless slip into recession.

I count on swift negotiations amongst these 4 nations, which is why I’m shopping for the inventory market dip. In a means, I am thrilled to have the ability to construct larger fairness positions for my youngsters, who’ve small inventory market portfolios. The concept of making youngsters millionaires earlier than they depart dwelling could also be a rising necessity. On the identical time, I see actual property as each a hedge towards uncertainty and a possible outperformer this yr and subsequent.

How Political and Financial Chaos Impacts Investments

When uncertainty spikes, fairness markets sometimes unload. Since shares produce nothing tangible, their worth depends on investor confidence and the flexibility to forecast future earnings. However buyers worry the unknown—very like moving into an already smelly elevator, solely to have another person stroll in and assume you’re the wrongdoer.

Nonetheless, actual property thrives in occasions of uncertainty. Why? As a result of capital seeks security and tangible belongings. When shares tumble, buyers flock to Treasury bonds and laborious belongings like actual property and gold, which have a tendency to carry their worth higher. Whereas equities can lose 10%+ in market cap in a single day, actual property stays a tangible, income-generating asset.

I beforehand wrote about how commerce wars might reignite the housing market. That prediction seems to be enjoying out now. With rates of interest inching decrease, the demand for actual property is growing.

The Influence of DOGE Cuts & Financial Uncertainty

To get a clearer image of the state of affairs in Washington, D.C., I reached out to Ben Miller, co-founder and CEO of Fundrise, who relies in Washington D.C.. His insights have been eye-opening, together with the dialogue of taking away, “stealth stimulus.” You may hearken to the episode by clicking the embedded participant beneath or going to my Apple or Spotify channel.

The DOGE cuts are occurring a lot sooner than anticipated, amplifying their impression. If the cuts have been gradual, their results can be extra manageable. As a substitute, the federal government is slashing jobs at an unprecedented tempo, aiming to root out waste and graft.

Whereas we are able to all agree that taxpayers deserve transparency in the place our cash goes and effectivity in authorities spending, the pace and scale of those cuts—together with the dearth of empathy for long-serving public workers—are regarding. My school roommate labored for USAID for eight years, doing nice work serving to to distribute meals and vaccinations in Africa—now he is shut out by means of no fault of his personal.

Sitting right here in San Francisco, the tech and startup hub of the world, I can’t assist however see parallels with the personal sector. In tech, layoffs occur swiftly, and corporations transfer on with out hesitation. It’s a brutal, aggressive world.

In the event you’re a authorities worker dealing with uncertainty, it could be clever to take into account accepting a severance package deal and transfer on. The following 4 years—maybe longer—will convey immense stress on federal and native workers to carry out beneath intense scrutiny.

You may even really feel as a lot stress as a private finance author elevating two younger youngsters and supporting a partner in costly San Francisco—with no twin incomes! In the event you do not love what you do, survival will probably be extraordinarily troublesome.

Which Sectors Thrived In the course of the Final Commerce Warfare?

With recent commerce conflicts brewing with China, Mexico, Canada, and probably Europe, it’s price revisiting previous market habits.

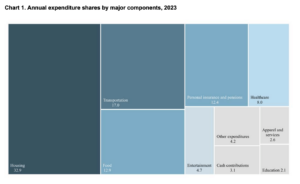

In the course of the 2018–2019 commerce battle, Goldman Sachs discovered that the top-performing sectors have been:

- Utilities – Low-beta monopolies with excessive dividends

- Actual Property – Onerous belongings that provide stability and earnings

- Telecom Providers – Defensive, cash-generating companies

- Shopper Staples – Important items that stay in demand

- Vitality – A hedge towards geopolitical instability

Actual property’s outperformance throughout turmoil isn’t shocking. When uncertainty rises, buyers rush into bonds, pushing yields decrease. Declining mortgage charges then make homeownership extra inexpensive, boosting housing demand.

Why Actual Property Might Outperform Shares in 2025

Whereas actual property underperformed shares in 2023 and 2024, that development is poised to reverse in 2025. I assign a 70% likelihood that actual property will outperform equities this yr.

Shares are vulnerable to sharp corrections primarily because of costly valuations and coverage uncertainty, whereas actual property continues to offer steady, low-volatility returns—one thing buyers crave in turbulent occasions. The U.S. already faces a multi-million-unit housing scarcity. With falling mortgage charges, pent-up demand, and a rising choice for stability, actual property ought to see sturdy help.

That doesn’t imply actual property will explode larger—it simply means shares doubtless gained’t ship the identical outsized good points we noticed in 2023 and 2024.

Ask your self:

- Would you reasonably spend money on shares at all-time highs, with valuations within the high decile, amidst all this uncertainty?

- Or would you favor industrial actual property with 7%+ cap charges, buying and selling at deep reductions just like the 2008 monetary disaster—regardless of in the present day’s stronger financial system and family steadiness sheets?

I lean towards laggard worth performs over frothy shares. On the identical time, a few of the finest occasions to purchase shares have been when the Financial Uncertainty Index was at equally elevated ranges—like in 2009 and 2020. Therefore, it could be clever to dollar-cost common into each belongings.

Don’t Get Complacent With Inventory Market Positive aspects

The previous two years have been distinctive for shares, delivering returns that felt like successful the lottery. However long-term returns are likely to normalize. Goldman Sachs, JP Morgan, and Vanguard all forecast subdued 10-year S&P 500 returns. If valuations mean-revert to a historic ahead P/E of 18x, upside potential is restricted. The truth is, there may very well be super draw back.

When you’ve made substantial good points, capital preservation ought to be your precedence. The first rule of economic independence is not dropping cash. The second rule is to not overlook the primary rule—but additionally to all the time attempt to negotiate a severance package deal in the event you plan to stop your job anyway. There isn’t any draw back.

2023 and 2024 have been items from the market. Let’s not assume 2025 will probably be simply as beneficiant. As a substitute, it’s time to recognize actual property and take into account including extra in the event you’re underweight. A 4%–8% regular return in actual property beats the wild swings of a inventory market that might erase wealth in a single day.

Conclusion: Onerous Property Win Throughout Uncertainty

When chaos, worry, and uncertainty dominate, buyers ought to return to the fundamentals—income-generating belongings and tangible belongings. Onerous belongings present utility, stability, and in some instances, pleasure.

As 2025 unfolds, don’t underestimate actual property’s position as a hedge towards uncertainty. If the world comes crumbling down, essentially the most valuable asset you’ll personal is your property. Do not take it with no consideration.

If you wish to spend money on actual property with out the burden of a mortgage, tenants, or upkeep try Fundrise. With about $3 billion in belongings beneath administration and 380,000+ buyers, Fundrise makes a speciality of residential and industrial actual property.

If the 10-year bond yield drops to three.5% or decrease and the typical 30-year fastened mortgage fee falls to six% or beneath, count on actual property demand to surge. Publicly traded ETFs and REITs will react shortly, however personal industrial actual property will supply a 3–4-month window of alternative because of longer transaction occasions. To capitalize on this timing lag, try Fundrise—my favourite platform for personal actual property investing.

I’ve personally invested $300,000 with Fundrise to generate extra passive earnings. The platform can also be a long-time sponsor of Monetary Samurai.

Readers, what are you doing, if something, throughout this time of uncertainty and chaos? Are you as optimistic on actual property as I’m?

To expedite your journey to monetary freedom, be part of over 60,000 others and subscribe to the free Monetary Samurai publication. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Every part is written primarily based on firsthand expertise and experience.