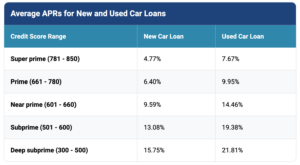

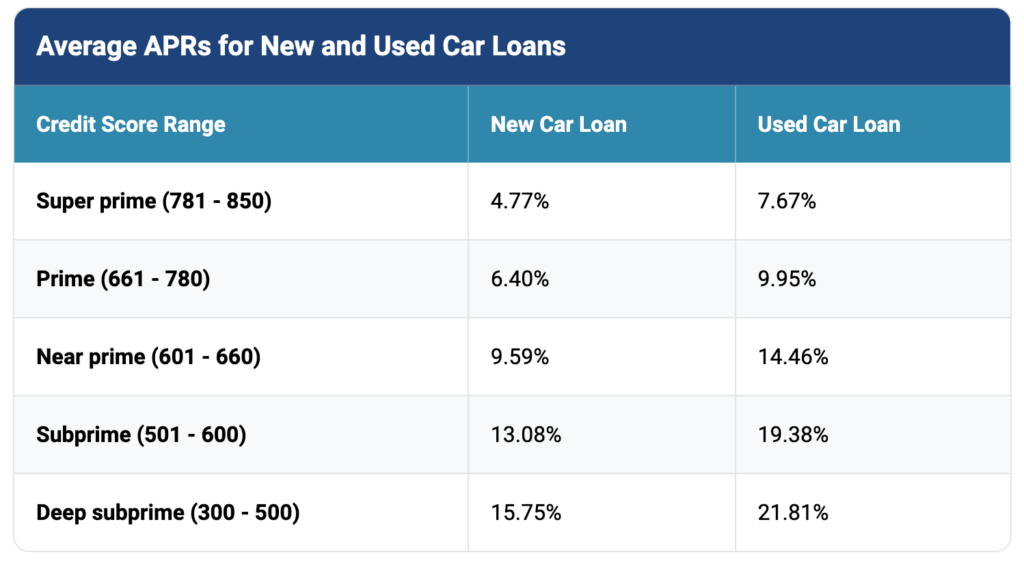

What is the common automobile mortgage price with spotty credit?

If sticker costs shock you, simply wait till you see the rates of interest…

Reply:

For a brand new automobile: 13.08%

For a used automobile: 19.38%

Questions:

- Give one instance of an motion that may trigger a borrower to have “spotty credit?”

- How does the rate of interest have an effect on the month-to-month cost on a automobile mortgage? Clarify.

- Assume a borrower with spotty credit took out a $20,000 automobile mortgage. Estimate what the entire price of the mortgage could be for a 60-month mortgage.

Listed below are the ready-to-go slides for this Query of the Day that you should use in your classroom.

Behind the numbers (Experian):

“You possibly can get a automobile mortgage with spotty credit, however you could have fewer choices and find yourself paying extra curiosity and charges than somebody with a better credit score rating.

When you’ve got a low credit score rating, think about whether or not shopping for a automobile proper now is sensible or if ready to enhance your credit score is a greater possibility. If it is advisable to purchase a automobile urgently, listed below are just a few steps you may take to organize and probably enhance your choices:

- Test your credit score. Though you possible will not know which credit score rating the lender will use, you may nonetheless examine one in every of your credit score scores and assessment your credit score report. You may discover that there are methods to shortly enhance your credit score rating earlier than making use of.

- Get prequalified. Some auto lenders supply on-line prequalification, which may present you estimated mortgage presents utilizing a mushy credit score inquiry. This course of would not have an effect on your credit score scores. Attempt to get presents from a number of sorts of lenders so you may evaluate phrases.

- Enhance your down cost. A bigger down cost may allow you to qualify for a decrease rate of interest. Even when it would not, borrowing much less cash will result in paying much less curiosity.

- Ask somebody to cosign. You may see if an in depth pal or member of the family who has good credit score is prepared to cosign the mortgage. It might allow you to qualify and get a greater supply, however they will even be legally responsible for the debt and the mortgage can have an effect on their credit score.”

About

the Writer

Kathryn Dawson

Kathryn (she/her) is worked up to affix the NGPF crew after 9 years of expertise in schooling as a mentor, tutor, and particular schooling trainer. She is a graduate of Cornell College with a level in coverage evaluation and administration and has a grasp’s diploma in schooling from Brooklyn Faculty. Kathryn is wanting ahead to bringing her ardour for accessibility and academic justice into curriculum design at NGPF. Throughout her free time, Kathryn loves embarking on cooking tasks, strolling round her Seattle neighborhood together with her canine, or lounging in a hammock with a e book.