SK hynix finalizes acquisition of Intel’s NAND enterprise, takes full management of Solidigm

What simply occurred? Intel and SK hynix have finalized an $8.85 billion deal that transfers Intel’s NAND flash reminiscence enterprise to the South Korean semiconductor large, marking the completion of a multi-year transaction that started in 2020. The ultimate section of the acquisition concluded with SK hynix making a $1.9 billion cost to Intel.

This ultimate installment secured essential property – together with mental property, analysis and improvement assets, and key personnel – enabling SK hynix to completely combine the NAND enterprise and Solidigm, its subsidiary fashioned from Intel’s SSD operations.

The acquisition unfolded in two phases over a number of years. The primary section, accomplished in December 2021, noticed SK hynix purchase Intel’s SSD enterprise and its NAND manufacturing facility in Dalian, China, for $6.61 billion. This section additionally included the rebranding of Intel’s enterprise SSD enterprise below the identify Solidigm, which continued working as a standalone entity below SK hynix’s possession.

Nonetheless, the preliminary transaction excluded important elements akin to Intel’s NAND-related mental property, R&D infrastructure, and technical workforce. These parts remained below Intel’s management throughout a transitional interval, limiting Solidigm’s capacity to collaborate totally with SK hynix on expertise improvement and product innovation.

The second and ultimate section of the deal, which closed on March 27, 2025, based on a regulatory submitting, addressed these gaps. With the newest $1.9 billion cost, SK hynix acquired Intel’s proprietary NAND IP and absorbed its R&D group and technical workers. This transfer grants Solidigm full operational independence and permits for seamless integration with SK hynix’s present operations. The unification is predicted to reinforce the event of next-generation storage merchandise.

Intel described the transaction as a strategic resolution to realign its enterprise priorities. The sale displays Intel’s broader pivot away from the more and more commoditized NAND market, which has confronted declining costs and profitability lately. As an alternative, Intel plans to deal with higher-growth areas akin to synthetic intelligence chips and superior semiconductor manufacturing.

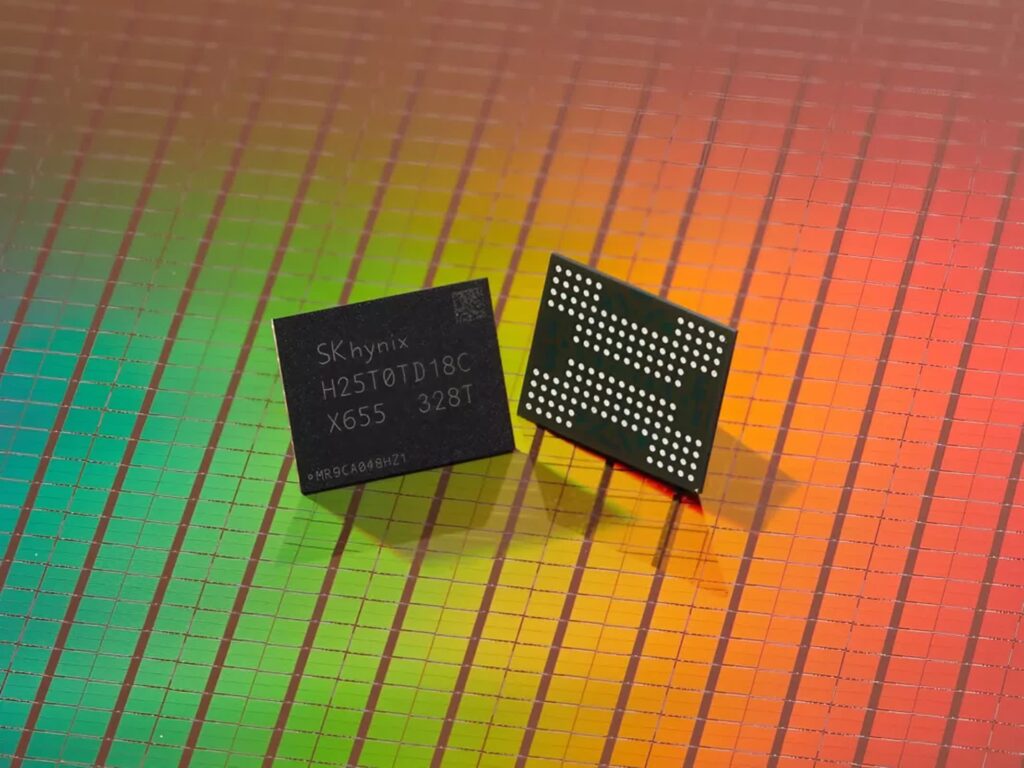

For SK hynix, the acquisition marks a major growth of its footprint within the world NAND market. By integrating Solidigm into its operations, SK hynix features entry to superior floating gate NAND flash expertise – an indicator of Intel’s legacy – and a longtime place within the enterprise SSD sector.

This positions SK hynix as a stronger competitor towards trade leaders akin to Samsung Electronics, which holds over 30% of the worldwide NAND market. With an estimated mixed market share of over 20%, SK hynix is now firmly established as one of many world’s largest NAND reminiscence producers.

Nonetheless, challenges lie forward as SK hynix navigates technological variations between its present operations and people inherited from Intel. Whereas SK hynix focuses on cost lure flash (CTF) expertise, Solidigm continues to provide high-endurance SSDs primarily based on Intel’s floating gate NAND expertise. This dual-technology strategy might require sustaining separate manufacturing strains within the brief time period to leverage the distinctive strengths of every course of. In the long run, nonetheless, SK hynix might search to consolidate round a unified manufacturing course of to cut back complexity and streamline operations.

The conclusion of this transaction additionally ends the settlement below which Intel had been producing NAND wafers at SK hynix’s Dalian facility throughout the transitional interval. With full operational management now transferred, each firms are free to pursue their respective strategic targets with out lingering contractual obligations.