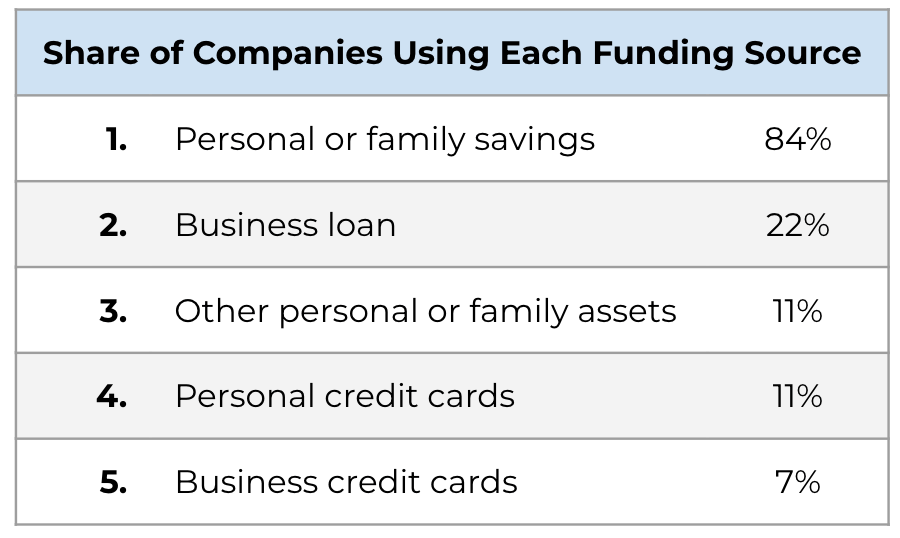

Funding supply used most frequently to begin new companies

Learn how most new companies get their funding.

Reply: 84%

84% of companies use private or household financial savings to get began.

Questions:

- The vast majority of companies use private or household financial savings as a funding supply. How may that have an effect on which companies get launched?

- What share of companies use a enterprise mortgage for funding?

- What’s one piece of vital info that’s NOT included within the chart of funding sources?

- Entry to wealth and credit score is inequitable. How may that affect the enterprise world?

Click on right here for the ready-to-go slides for this Query of the Day that you need to use in your classroom.

Behind the Numbers (altLINE):

“Private or household financial savings is the commonest supply of enterprise startup capital, in accordance with Census Bureau information. The advantages of this methodology are clear: You’re utilizing current fairness to launch a enterprise moderately than taking over debt, so that you received’t owe curiosity or need to stress about reimbursement.

Sadly, most People don’t have important financial savings that can be utilized for this function, and that is much more true for minority communities. The typical American’s financial savings account stability is $4,500, and 42% of People have lower than $1,000 in a financial savings account. There’s additionally a big hole in common financial savings balances primarily based on gender, race, and schooling degree.”

—————-