How To Make Your Kids Millionaires Earlier than They Depart Dwelling

If you happen to don’t consider the world will grant your kids a good probability to succeed, chances are you’ll wish to take issues into your individual arms as mother and father. A method is to set them up for monetary independence—ideally making them millionaires earlier than they graduate highschool, end faculty, or go away residence.

In case your kids are millionaires by maturity, rejections from faculties or employers will matter far much less. With monetary safety, they’ll stay independently, purchase a automobile with money, and afford a 20% down fee on a median-priced residence. As soon as housing and transportation are coated, most different bills change into manageable.

I do know some might discover the thought of creating their kids millionaires unrealistic, even absurd. However in 2025, what feels much more absurd is the existence of various requirements for various individuals primarily based on their identities. I totally assist serving to these from deprived financial backgrounds and people with disabilities. However penalizing individuals for the rest however who they’re feels off.

That’s why probably the most logical answer is to attain monetary independence—so that you and your kids don’t need to depend on biased gatekeepers. They’re in all places.

Turning into Millionaires vs. Receiving Hundreds of thousands

It’s necessary to tell apart between mother and father merely handing their youngsters one million {dollars} and kids changing into millionaires via arduous work, saving, and investing. I would like the latter—in order that they be taught the basics of private finance and develop a robust, constant work ethic.

Loads of households can afford to provide their kids substantial wealth. I often see The Financial institution of Mother & Dad in motion—shopping for their youngsters vehicles, properties, and even masking personal college tuition and groceries. That’s definitely their proper. Nevertheless, offering an excessive amount of monetary assist can create long-term dependence—the precise reverse of monetary independence.

That’s why, utilizing ProjectionLab’s incredible wealth-planning instruments, I wish to discover whether or not it’s even potential to assist kids change into millionaires earlier than they go away residence. When you log onto ProjectionLab, merely enter the targets as proven under. Now let’s run via some situations!

How A Youngster Can Develop into A Millionaire By The Time They Depart The Home

Now that we have mentioned why it might be useful for a kid to change into a millionaire earlier than maturity, let’s break down precisely how one can make it occur. The 2 main methods are via work and investing. The earlier a baby begins, the higher—due to the magic of compound progress.

Working As A Youngster

As a common rule, the Honest Labor Requirements Act units the minimal age for employment at 14, with limits on the hours labored for these beneath 16. But when a child needs to change into a millionaire by 18, beginning work at 14 could also be too late.

I labored at McDonald’s for $4/hour at 15. It was a horrible job, and I blew all my cash on films, sports activities gear, and happening dates. If I had been smarter, I’d’ve began working earlier and invested my earnings as a substitute.

However on the time, the Roth IRA had not been invented but. Additional, my mother and father weren’t private finance fans with million-dollar mindsets. However you’re by the actual fact that you just’re excited studying this put up!

Fortunately, youngsters right now have extra alternatives to earn earnings earlier than age 14, corresponding to:

- Promoting sweet and different objects to classmates

- Mowing lawns or raking leaves

- Tutoring different youngsters

- Babysitting

- Modeling for advertising supplies

- Operating a YouTube or TikTok channel

- Running a blog about video games or hobbies

The hot button is to generate earnings from exterior the family, increasing the earnings pie as a substitute of simply shifting it round from Financial institution of Mother & Dad to little one. If a baby can earn cash from each exterior sources and their mother and father, even higher.

Investing As A Youngster To Develop into A Millionaire

There are three main methods a baby can make investments:

- Roth IRA – Contributions should come from earned earnings. If a baby earns cash, opening a Roth IRA is a no brainer to save lots of on taxes.

- Custodial Funding Account – Funded by each earned earnings and parental contributions, with mother and father sustaining management till maturity.

- 529 School Financial savings Plan – Contributions normally come from mother and father or grandparents, however this will nonetheless be half of a kid’s web value since schooling is an asset. Kids also can contribute to their 529 plans. Let’s simply take into account this a bonus for now.

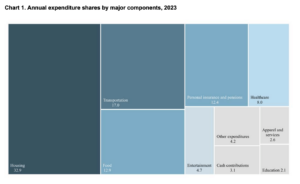

Under we enter the assumptions in ProjectionLab.

How A lot To Earn and Make investments to Develop into a Millionaire

Let’s calculate how a lot a baby should earn and make investments to achieve $1 million by ages 18, 22, and 25. 18 is normally the age youngsters graduate from highschool. 22 is normally the earliest a child graduates from faculty. And 25 is an age the place I might just like the grownup little one to lastly go away residence.

Millionaire By 18: Beginning At Beginning

If a baby begins investing from delivery, they’ve probably the most time for compounding. Right here’s the way it may work:

- Mother and father personal a enterprise or begin a facet hustle and legally make use of their little one for advertising or content material creation.

- The kid earns sufficient to max out a Roth IRA at $7,000 yearly.

- All extra earnings ($20,000) go right into a custodial funding account.

- Mother and father contribute $36,000 yearly to a 529 plan.

- Investments develop at 8% yearly for shares and 5% for the 529 plan.

This is what the highway to millionaire by 18 beginning at delivery would seem like utilizing ProjectionLab:

Projected Internet Value at 18:

- Roth IRA: $7,000/yr at 8% for 18 years = ~$265,000

- Custodial Funding Account: $20,000/yr at 8% for 18 years = $759,000

Mixed, the kid reaches a web value of $1,024,000. Hooray! All a baby has to do as quickly as they arrive out of the womb is earn $27,000 a yr for 18 years and earn an 8% compound annual return. However wait, there’s the 529 Plan stability to calculate as nicely.

- 529 Plan: $36,000/yr at 5% for 18 years = ~$1,020,000

Whole Internet Value by 18 together with the 529 Plan: ~$2,045,000. Any leftover funds in a 529 Plan may be reassigned to a different beneficiary, corresponding to future grandkids. Moreover, as of now, as much as $35,000 of unused 529 funds may be rolled over right into a Roth IRA.

Whereas together with a 529 Plan in your kid’s web value is debatable, it stays some of the tax-efficient methods to switch wealth throughout generations. In case your kids have youngsters of their very own, any remaining 529 funds will probably be a precious useful resource. In spite of everything, one of many main causes mother and father work, save, and make investments is to fund their kids’s schooling.

Excluding the 529 School Financial savings plan would seem like this:

Millionaire By Age 22 Beginning At Age 8 (14 years):

For instance making a living as a child is merely out of the query, which for many households, it’s. Then how about we assume your little one begins at a extra cheap age to earn cash, at age eight, and works and invests for the subsequent 14 years. My son is eight this yr and I positively plan to place him to work as a Monetary Samurai worker. He’ll discover ways to edit and replace older posts.

Let’s calculate how a lot he would wish to earn, make investments, and return to get to $1 million by age 22 beginning at 14. Under are the varied assumptions I’ve plugged into ProjectionLab.

- Roth IRA: $7,000/yr common at 8%: $186,000

- Custodial Account: $6,765/yr at 8%: $179,000

- 529 Plan: $32,000/yr at 5%: $663,000

- Whole: ~$1,029,000

- Annual Contribution: $45,785

Incomes and investing $13,765 a yr on common for 14 years appears fully cheap. A toddler would wish to work for 13.3 hours per week at $20 an hour to get to $13,765 a yr. I feel that is extremely possible, particularly given the minimal wage ought to go up over this time interval. However this might solely get the kid to a web value of $365,000 at age 22. Not dangerous, however no millionaire.

If we exclude the 529 Plan, then the kid must improve their annual saving and investing quantity from $13,765 to $45,785 to change into a millionaire by 22 all by themselves. That sounds tough to do as a full-time pupil. Nevertheless, there are many methods to earn cash on-line now that would simply surpass $45,785 a yr. We’ll see how within the part under.

Millionaire By 25: Beginning At Age 14 With out Parental Contribution

If making your child work at eight nonetheless sounds too excessive, let’s begin at age 14 and proceed till age 25. By beginning at 14, a baby can change into a millionaire by age 25 with out parental contributions if:

- Youngster earns: $61,000/yr

- Roth IRA: $7,000/yr at 8% for 11 years → ~$118,000

- Custodial Account: $54,000/yr at 8% for 11 years → ~$914,000

- Whole Internet Value by 25: ~$1,032,000

- Requirement: The kid should generate $61,000 in annual earned earnings (e.g., via a profitable on-line enterprise, content material creation, or uncommon expertise).

Nevertheless, that’s after taxes. After years of paying Uncle Sam, your child would even have $139K much less of their custodial account—which means they’d must work two extra years or earn nearer to $70K per yr to achieve millionaire standing.

Alternatively, The Financial institution of Mother & Dad can merely make up the distinction. In case your little one begins diligently working at age 14 for 11 years and does one thing entrepreneurial, it could be arduous for a mum or dad to not assist out indirectly. That is fairly a accountable little one!

How To Earn $61,000 A 12 months Beginning As A Teenager

Incomes $61,000 a yr after taxes from age 14 to 25 (an 11-year span) is a lofty purpose for a youngster, particularly beginning with no prior earnings or expertise. This averages out to about $5,083 per thirty days or roughly $1,250 per week.

For context, that’s nicely above the U.S. federal minimal wage for full-time work ($7.25/hour, or $15,080/yr for 40 hours/week). Additional, teenagers face authorized restrictions on hours and job sorts, plus the calls for of faculty. Nonetheless, it’s not unattainable with distinctive effort, creativity, and a few luck.

Listed here are reasonable methods a baby may work towards that earnings degree, assuming they maintain it yearly from 14 to 25. Please keep in mind that I have been technically making a living on-line since 2009, so I’ve a deep understanding of how to take action.

1. Begin a Scalable On-line Enterprise

- What: Launch a enterprise like dropshipping, print-on-demand (e.g., t-shirts, mugs), or digital product gross sales (e.g., eBooks, templates) by way of platforms like Shopify, Etsy, or Gumroad.

- How: At 14, they might start with a low-cost area of interest (e.g., gaming merchandise or research guides for friends), reinvesting earnings to scale. By 16–17, with a robust social media presence (TikTok, Instagram, YouTube), they might drive critical visitors.

- Earnings Potential: Early years may web $5,000–$10,000 yearly, however by 18–25, a well-run operation may hit $61,000/yr with constant progress and advertising savvy.

- Realism: Requires studying digital advertising and a few upfront money (e.g., $500–$1,000), however teenagers like Isabella Barrett (millionaire by 6 by way of jewellery) present youngsters can scale companies younger.

2. Content material Creation (YouTube, Twitch, TikTok)

- What: Create movies or streams—gaming, tutorials, vlogs, or area of interest hobbies—monetized by way of advertisements, sponsorships, and merch.

- How: Begin at 14 with a parent-managed account (YouTube requires 13+, Twitch 13+ with supervision). Construct a following over years; monetization kicks in with 1,000 subscribers and 4,000 watch hours (YouTube) or 50 followers and constant streaming (Twitch).

- Earnings Potential: High earners like Ryan Kaji ($30M/yr at 9) are outliers, however $61,000/yr is doable by 18–25 with 50,000–100,000 followers and a number of income streams (advertisements: $3–$5/1,000 views, plus offers).

- Realism: Takes 2–3 years to achieve traction, plus modifying abilities and persistence. Many teenagers abandon this early, however those that follow traits (e.g., short-form content material) can break via.

Or possibly they burn out or face an algorithm change that drastically cuts their earnings—one thing that occurs on a regular basis within the on-line world, particularly now that AI is reshaping industries. Even after grinding via college and going full-time post-graduation, earnings isn’t all the time assured to final.

With ProjectionLab, I can mannequin out completely different situations, together with potential earnings drop-offs. However by the point that occurs, the kid is already a millionaire, due to sensible incomes, investing, and compounding. Operating these projections helps guarantee monetary safety, it doesn’t matter what life throws their method.

3. Freelancing Excessive-Worth Abilities

- What: Supply companies like graphic design, coding, video modifying, or writing on platforms like Fiverr or Upwork.

- How: At 14, be taught abilities by way of free assets (YouTube, Codecademy). By 15–16, take small gigs ($10–$20/hour), constructing a portfolio. By 18, cost $50–$100/hour for specialised work (e.g., app growth).

- Earnings Potential: $61,000/yr means ~1,220 hours at $50/hour—about 23 hours/week. Teenagers may hit this by 17–18 with hustle and ability.

- Realism: Requires self-taught experience and shopper belief (more durable as a minor), however teenagers like Stanley Tang (DoorDash co-founder at 20) show younger expertise can earn large.

4. Aggressive Gaming or Esports

- What: Compete in video games like Fortnite, Valorant, or League of Legends, incomes prize cash and sponsorships.

- How: Begin at 14 working towards 20–30 hours/week, becoming a member of novice tournaments (e.g., by way of Battlefy). By 16–17, intention for professional qualifiers or streaming income.

- Earnings Potential: High gamers earn tens of millions, however mid-tier execs could make $50,000–$100,000/yr by 18–25 by way of winnings and offers.

- Realism: Wants elite ability (high 1% of gamers) and parental assist for journey. Most don’t make it, however dedication can repay—e.g., Kyle Giersdorf gained $3M at 16 in Fortnite. If you happen to change into a high participant, you possibly can then create content material on YouTube and monetize your content material since you’ve gotten authority. Simply know that each one this display screen time at a younger age is probably not good for youths.

5. Teen Entrepreneur with Native Providers

- What: Run a service like garden care, automobile washing, or tutoring, increasing to a small crew by 16–17.

- How: At 14, cost $20–$30/job within the neighborhood (authorized beneath FLSA exemptions for self-employment). By 16, rent buddies, scale to $100–$200/day.

- Earnings Potential: 10 lawns/week at $30 = $15,600/yr initially; scaled to twenty jobs/week at $50 = $52,000/yr by 18, plus further summer season work to hit $61,000.

- Realism: Doable with hustle and word-of-mouth, although restricted by college hours (max 18 hours/week throughout phrases for 14–15-year-olds).

6. Investing In The Inventory Market And Different Danger Property

- What: Make investments earnings within the S&P 500, progress shares, and even crypto by way of a custodial account, aiming for top returns.

- How: At 14, use earnings from chores or small gigs ($5,000/yr) to speculate by way of a parent-managed account. Concentrate on progress shares or risky belongings (e.g., Bitcoin), which have the potential to compound at an excellent increased fee than the S&P 500.

- Earnings Potential: $5,000/yr at 15% common return over 11 years = ~$163,000 complete, however lively buying and selling may push annual positive aspects to $61,000 by 20–25.

- Realism: Dangerous with the next chance of dropping cash. Requires monetary literacy and luck. Most lively merchants underperform the S&P 500 or index of their alternative. Nevertheless, you will get fortunate. I invested $3,000 in a Chinese language web firm known as VCSY in early 2000 and it went up 50X. So that you by no means know except you strive.

Placing It Collectively To Develop into Millionaire By 25

A sensible path may mix these:

- Ages 14–16: Begin with freelancing ($10,000/yr) and content material creation (constructing viewers).

- Ages 17–19: Scale freelancing to $30,000/yr, monetize content material for $20,000/yr, add native companies ($15,000/yr).

- Ages 20–25: Hit $61,000/yr persistently as abilities, viewers, and enterprise mature.

After all, this path gained’t be straightforward—however nothing worthwhile ever is! Extra importantly, nothing occurs if {the teenager} doesn’t begin. As mother and father, we should always do all the things we will to train, encourage, and assist them, all whereas making certain they keep on high of their schoolwork. The sooner they start, the higher their monetary benefit will probably be.

Parental Monetary Match: A Probably Necessity

To make it simpler for his or her kids to achieve one million {dollars} by the point they’re adults, mother and father can implement a parental match, just like how corporations match 401(okay) contributions to encourage financial savings. An affordable match may vary from 20% to 100% of what the kid earns. Nevertheless, exceeding a 100% match might diminish the kid’s sense of delight in incomes cash independently.

For instance, if a baby must earn $61,000 per yr on common from age 14 to 25 to achieve millionaire standing, a 100% parental match would scale back their required earnings to $30,500 yearly. Nevertheless, mother and father needs to be aware of tax implications when gifting quantities above the present tax exclusion, which is $19,000 per mum or dad or $38,000 per married couple per little one.

The Splendid Parental Monetary Match For Their Children

Personally, I consider matching as much as the annual present tax exclusion is a good technique, particularly when you anticipate your property rising past the property tax threshold ($13.99 million per particular person). This strategy encourages the kid to earn no less than as much as the present tax restrict, fostering each monetary duty and motivation. In the event that they aspire to earn extra, the remaining is as much as them.

By having mother and father contribute, it creates buy-in from them as nicely. This involvement encourages mother and father to share their monetary knowledge, serving to their kids develop a stronger understanding of wealth-building. Because of this, kids usually tend to take their funds critically and make smarter monetary choices sooner or later.

Remaining Ideas on Making Your Youngster a Millionaire

Turning into a millionaire by age 25—not to mention 18—isn’t straightforward, however with the fitting mixture of incomes, investing, and compounding, it’s achievable. It is extra reasonable to assist your little one construct wealth than to count on them to earn straight A’s, rating a 1,590 on the SAT, and nonetheless face rejection from high faculties.

Even when they fall wanting the millionaire mark by 18, 22, or 25, they’ll nonetheless have important monetary safety and robust private finance fundamentals to information them via life.

Mother and father play a essential function on this journey by sharing monetary data and increasing alternatives past the normal 9-to-5 path. The extra we perceive how cash is made and grown, the extra we will cross these classes on, fostering an entrepreneurial mindset that may pay dividends for generations.

The world won’t ever be completely honest. However that doesn’t imply we shouldn’t strive our greatest, even when the chances are stacked in opposition to us. As a Monetary Samurai, you don’t complain—you’re taking motion! A robust monetary basis offers us the facility to navigate challenges with confidence and independence.

Think about This Dream Situation for Mother and father

Think about this plan in motion. With the correct mix of parental assist, arduous work, and sensible monetary choices, your little one turns into a millionaire by 18, buys a duplex at 21, upgrades to a single-family residence at 27, and reaches a $2.5 million web value by 30.

Because of their monetary safety, they’re beneficiant, grounded, and capable of pursue a significant profession. Whereas working to save lots of the rainforest—and rescuing child pandas alongside the best way—they meet one other nature lover. One factor results in one other, and so they fall in love, get married, and begin a household years later.

As mother and father, you’re feeling immense satisfaction understanding you gave your little one the inspiration for a satisfying life. Then, as grandparents, you expertise one other layer of pleasure. And when your time comes, you allow this world at peace, understanding your loved ones is safe—all due to a little bit monetary planning early on.

Priceless

That will help you and your little one visualize and plan this journey, I extremely advocate ProjectionLab. With its highly effective monetary modeling instruments, you possibly can create detailed, customized projections for web value progress, funding methods, and monetary milestones.

Whether or not you’re mapping out their path to changing into a millionaire or fine-tuning your individual monetary independence plan, ProjectionLab makes it straightforward to check completely different situations and optimize your technique.

Reader Questions

What are your ideas on serving to your kids change into millionaires earlier than they go away residence? If carried out proper, wouldn’t this set them up for a a lot happier and safer future? On the flip facet, may instructing youngsters about arduous work, investing, and cash administration too early have unintended downsides?

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai publication. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Every part is written primarily based on firsthand expertise and experience. I take advantage of ProjectionLab and it’s a Monetary Samurai affiliate.