9 Ridiculous Causes Why DINKS Are Broke

You’d suppose that dual-income households with out youngsters (DINKS) could be thriving financially, however many discover themselves struggling to make ends meet. Let’s discover some surprisingly frequent but absurd the reason why these {couples} is perhaps experiencing monetary difficulties regardless of their obvious benefits.

1. The “Instagram-Worthy” Luxurious Residence

The 15-foot ceiling with crown molding and a rotunda. You’ve seen it in your feed. These high-earning {couples} typically fall into the entice of renting upscale flats in stylish neighborhoods, full with rooftop swimming pools and tricked-out home equipment. The astronomical hire consumes a good portion of their earnings, generally reaching 40-50% of their month-to-month earnings. Whereas the situation is perhaps excellent for social media pictures, the monetary burden creates a perpetual cycle of dwelling paycheck to paycheck.

2. The Do-Something Pet Father or mother

DINKS steadily channel their nurturing instincts into pet possession, however not simply any pets — designer breeds with fussy stomachs. These furry members of the family get pleasure from premium natural meals, month-to-month subscription containers, and common spa remedies. Veterinary insurance coverage, skilled canine walkers, and daycare companies rapidly add as much as hundreds yearly. The emotional success of pet parenthood comes with a hefty price ticket.

3. Weekend Warrior Buying Syndrome

With out youngsters to occupy their weekends, many DINKS fall into the behavior of leisure buying as leisure. Saturday afternoons at high-end malls change into an everyday ritual, resulting in impulsive purchases of designer clothes, the most recent devices, and residential decor gadgets they don’t want. The justification of “we labored exhausting all week” turns into a harmful mantra that permits extreme spending.

4. Aggressive Journey Chronicles

Social media stress drives many DINKS to take care of an aggressive journey schedule, typically planning elaborate holidays to unique places a number of occasions per yr. Moderately than specializing in significant experiences, they prioritize capturing excellent pictures for his or her social media feeds. The competitors to go to extra nations and keep at extra luxurious resorts than their friends results in astronomical bank card payments.

5. Connoisseur Meals Obsession

Caviar, anybody? The liberty from getting ready kid-friendly meals typically interprets into an costly foodie way of life. DINKS frequently splurge on high-end eating places, unique cooking components, and premium wine subscriptions. Their kitchen drawers overflow with barely-used specialised cooking devices bought throughout late-night on-line buying sprees.

6. The Skilled Picture Paradox

Sustaining a refined skilled look turns into an costly obsession for a lot of DINKS. Common salon visits, designer workwear, and premium grooming merchandise create a considerable month-to-month burden. The stress to look profitable of their careers drives them to spend money on standing symbols like luxurious watches and designer baggage.

7. The Health Life-style Fantasy

Many DINKS keep a number of gymnasium memberships, together with boutique health studios, conventional gyms, and specialised coaching packages. They spend money on the most recent athletic put on, smartwatches, and restoration devices. Regardless of spending tons of month-to-month on fitness-related bills, many of those subscriptions go underutilized. The aspiration to take care of an ideal health routine typically leads to wasted cash relatively than improved well being.

8. The Facet Hustle That Prices Extra Than It Makes

Of their quest for extra earnings, DINKS typically pour cash into poorly deliberate aspect ventures. Whether or not it’s trying to change into social media influencers, beginning an e-commerce enterprise, or investing in questionable cryptocurrency schemes, these endeavors steadily lead to important losses. The preliminary funding in tools, stock, or coaching programs typically exceeds any potential returns, creating one other monetary drain relatively than a supplementary earnings stream.

9. The Retirement Procrastination Downside

Regardless of their larger mixed earnings, many DINKS postpone retirement planning in favor of speedy gratification. The absence of youngsters creates a false sense of monetary safety and fewer perceived obligations for the long run. They typically neglect to maximise their retirement contributions, believing they’ve loads of time to catch up later. This short-sighted method to monetary planning finally leaves them susceptible and unprepared for his or her golden years.

Breaking Free from the Entice

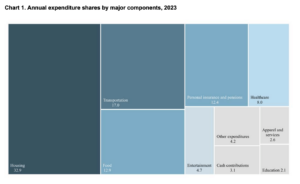

The trail to monetary freedom for DINKS requires trustworthy self-assessment and strategic planning. Whereas having fun with the advantages of a twin earnings is pure, establishing a steadiness between present way of life and future safety is essential. Take into account implementing a 50/30/20 finances rule, the place 50% goes to requirements, 30% to desires, and 20% to financial savings and investments.