Tax Cuts for the Center Class and Retirees: A Win for Your Pockets

On February 6, 2025, the White Home introduced a sequence of tax cuts primarily benefitting the center class and retirees. Right here’s what’s on the desk:

- No tax on ideas

- No tax on Social Safety advantages for seniors

- No tax on extra time pay

- Renewing the Trump Tax Cuts from the 2017 Tax Cuts and Jobs Act

- Adjusting the SALT cap

- Eliminating particular tax breaks for billionaire sports activities workforce homeowners

- Closing the carried curiosity loophole for hedge fund managers

- Tax cuts for Made in America merchandise

The administration is looking this the largest tax lower in historical past for working People, and with Republicans in charge of Congress, these proposals are more likely to transfer ahead.

Tax Cuts Means Better Monetary Freedom

As somebody who’s dedicated to serving to as many individuals as potential attain monetary freedom sooner, it’s arduous to not be pro-tax cuts. In any case, the extra money we hold, the higher wealth we are able to construct to dwell our desired existence. This isn’t about politics—it’s about financial alternative and private finance technique.

One of many greatest causes I retired early in 2012 was as a result of I didn’t need to grind away 60+ hours per week, continually pressured and coping with power ache, solely to hand over ~40% of my earnings in taxes. As an alternative of complaining, I selected to make much less cash and negotiate a severance bundle. If taxes have been decrease, I might have labored for at the least 4 extra years.

Making 80% much less cash that first yr felt bizarre initially, however not paying six figures in earnings taxes and having fun with the freedom of public parks on a weekday felt unbelievable.

In fact, tax cuts imply much less authorities income, so the White Home is in search of spending cuts to compensate. Whereas USAID (1% of spending) and different discretionary spending packages would possibly see reductions, the true problem is in reducing main price range objects.

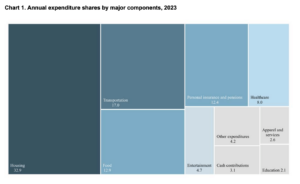

U.S. Authorities Spending Breakdown

The federal government spent about $6.75 trillion in 2024 in response to the Treasury Division, with Social Safety, Nationwide Protection, and Well being comprising of fifty% of complete spending. Therefore, if the White Home needs to run a balanced price range, it should discover and equal quantity of cuts and/or have extra financial progress. Here is the highest 5 spending breakdown:

- Social Safety (21%)

- Nationwide Protection (15%)

- Medicare & Well being (13%)

- Curiosity on Debt (13%)

- Earnings Safety & Different Entitlements (9%)

Breaking Down the Proposed Tax Cuts

Let’s now undergo every of the proposed tax cuts.

1) No Tax on Ideas

Huge win for service employees. Should you work for ideas, you usually depend on buyer generosity to make a dwelling. You need to get to maintain 100% of what you earn. Many restaurant servers, bartenders, and lodge employees barely scrape by, so this tax exemption is properly deserved.

2) No Tax on Social Safety for Seniors

Incredible transfer for retirees. Seniors paid into the system their total lives. Taxing their already modest advantages by no means made a lot sense. On condition that Social Safety advantages already present a poor return in comparison with investing within the inventory market or perhaps a 60/40 portfolio, letting retirees hold extra of their cash is a good coverage.

At present, FICA taxes require employers to withhold 6.2% Social Safety tax and 1.45% Medicare tax from an worker’s wages. Employers should match these taxes, bringing complete FICA contributions to fifteen.3%.

The quantity of tax-free earnings retirees can earn will hold going up, which implies much less monetary burden for his or her youngsters and for society. Retirees should lastly hold extra of what they’ve paid in.

3) No Tax on Additional time Pay

That is an enormous incentive for employees to place in additional hours and work tougher – one in every of my predictions for what a second Trump presidency means in your funds. Eliminating extra time taxes means increased take-home pay, which in flip boosts spending, saving, and investing. It could additionally result in a stronger GDP as employee output will increase.

I’ve at all times believed folks can work longer than the commonplace 40 hours per week in the event that they need to get forward financially. Now, with tax-free extra time, there’s a fair higher incentive to hustle. I in all probability would have simply labored 5 extra years if I obtained to maintain 20 hours per week of earnings tax free.

4) Renewing the Trump Tax Cuts from the 2017 Tax Cuts and Jobs Act

This transfer brings certainty to taxpayers and companies, which is sweet for buyers. One of many greatest issues earlier than 2025 was that the 2017 tax cuts would expire, leaving monetary planners, buyers, and companies scrambling. Now, there’s not as massive of a rush to conduct Roth IRA conversions both.

Key provisions being renewed:

- Decrease particular person tax charges, together with the high price discount from 39.6% to 37%.

- Greater commonplace deduction: $15,000 for people, $30,000 for married {couples} that ought to hold going up.

- Company tax price stays at 21% (down from 35% pre-2017).

- 20% deduction for pass-through enterprise homeowners, benefiting entrepreneurs.

- Territorial tax system: U.S. firms not pay taxes on overseas earnings.

5) Adjusting the SALT Cap

The State and Native Tax (SALT) deduction cap was launched in 2017, limiting the quantity of property, earnings, and gross sales taxes that taxpayers may deduct from their federal tax invoice to $10,000 per yr.

This disproportionately damage owners in high-tax states like California, New York, Connecticut, Hawaii, Washington, Massachusetts, and New Jersey. If the cap is adjusted, higher-income owners may save 1000’s. Since 2017, house costs all over the place have risen aggressively. Therefore, it’s not simply the costly states that can profit from a better SALT cap.

As an alternative of a blanket cap, I’d wish to see the SALT cap adjusted based mostly on native house costs. A $10,000 cap in Mississippi may be very totally different from a $10,000 cap in San Francisco. A proportional adjustment makes extra sense.

Greater SALT caps may lead to a noticeable uptick in demand for actual property in increased priced cities. With the return to the workplace motion additionally constructing momentum, we should always see massive metropolis actual property shine within the coming years.

6) Eliminating Particular Tax Breaks for Billionaire Sports activities Crew Homeowners

Does anybody care? In all probability not. But it surely raises the query—why did they get tax breaks within the first place? Billionaire workforce homeowners don’t want particular remedy. Steve Ballmer (L.A. Clippers proprietor, ~$122 billion web value) can afford to pay extra taxes.

7) Closing the Carried Curiosity Loophole

The carried curiosity loophole permits hedge fund managers and personal fairness buyers to have their performance-based compensation taxed on the decrease capital features price (20%) as an alternative of the upper atypical earnings price (37%).

As a restricted companion in eight personal funds, I do not thoughts. It’s an unfair benefit that lets rich buyers pay decrease taxes than salaried employees. Sure, the final companions have to take a position for the long run, which helps fund entrepreneurship, innovation, and financial progress. However such an enormous distinction in tax charges appears egregious. Closing this loophole will generate billions in further tax income with out impacting most People.

8) Tax Cuts for Made in America Merchandise

That is an incentive to increase home manufacturing. By decreasing taxes on items produced within the U.S., firms have extra causes to maintain manufacturing at house, creating extra American jobs. That is one other win for the American employee.

What Occurs Subsequent?

With Republicans controlling Congress, these tax cuts have a sturdy likelihood of passing. Nonetheless, negotiations over which cuts keep and the way they’re funded will doubtless take months.

For now, the main target is on decreasing authorities spending to assist offset misplaced income. Whereas businesses like USAID solely account for about 1% of the federal price range, bigger cuts might want to come from elsewhere if the administration needs to keep away from including to the nationwide debt.

Much less Taxes, Extra Environment friendly Authorities

For middle-class People and retirees, these tax cuts may very well be a main monetary win. Should you:

- Work a tipped job

- Depend on Social Safety

- Put in lengthy hours with extra time pay

- Personal a small enterprise or pass-through entity

- Stay in a high-tax state affected by the SALT cap

You can see actual advantages within the years forward. Tax cuts like these present extra monetary flexibility, serving to People save, make investments, and construct wealth quicker.

Personally, I’m most enthusiastic about no taxes on Social Safety advantages and the potential improve within the SALT cap. I do not issue Social Safety into my retirement plans, so having this tax-free earnings beginning in my mid 60s means much less of a necessity to avoid wasting and make investments. I’m additionally thrilled to probably decrease my annual six-figure property tax invoice given how inefficient my metropolis authorities is. Any financial savings will go towards elevated spending on my household.

Given our propensity to spend, we must also take into account how these tax cuts would possibly affect inflation. Let’s see if People truly get to maintain extra of our hard-earned cash!

Readers, what are your ideas on these newest tax cuts? Do you agree with them, or do you assume some go too far? How a lot are you paying in taxes annually, and the way would these adjustments affect you? Additionally, what are your ideas on DOGE’s aggressive cuts to USAID and different authorities organizations? Are these the best areas to reduce, or will there be unintended penalties? Let’s talk about!

Order My New Ebook: Millionaire Milestones

Should you’re able to construct extra wealth than 90% of the inhabitants, seize a duplicate of my new e-book, Millionaire Milestones: Easy Steps to Seven Figures. With over 30 years of expertise working in, finding out, and writing about finance, I’ve distilled every little thing I do know into this sensible information that will help you obtain monetary success.

Being within the center class is good, however let’s be trustworthy, life will get higher when you might have extra money. Monetary safety offers you the liberty to dwell in your phrases and the peace of thoughts that your youngsters and family members are taken care of.

Millionaire Milestones is your roadmap to constructing the wealth you’ll want to dwell the life you’ve at all times dreamed of. Order your copy in the present day and take step one towards the monetary future you deserve!

Subscribe To Monetary Samurai

Should you’re in search of a robust wealth-planning software, try ProjectionLab. It lets you visually create many what-if situations that may enable you higher plan in your future. There’s a free model and a premium model.

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and talk about a number of the most fascinating subjects on this web site. Your shares, scores, and opinions are appreciated.

To expedite your journey to monetary freedom, be part of over 60,000 others and subscribe to the free Monetary Samurai publication. You may as well get my posts e-mailed to you as quickly as they arrive out by signing up right here.

Monetary Samurai was established in 2009. Every thing is written based mostly on firsthand expertise and experience. You’ll be able to study extra by trying out my About web page.